Zenith Romania: Romanian advertising market – decrease of investments for the 4th year in the row

Zenith Romania predicts that Romanian advertising market will continue to decrease in 2012, for the 4th year in the row, as the political situation keeps being unstable, affecting the economy (depreciation of local currency being one of the most visible indicators and with immediate and major impact), and the consumption keeps dropping.

The media investments decline for Romania in 2012 is a slight one, but it’s still hurtful considering the potentially positive premises for this year. Moreover, the local and global (mainly European) difficult context doesn’t help with long term visibility, the quarterly revisions not being just small differences, but even major changes.

On the other hand, it is remarkable that the media market continues to offer many communication opportunities in Romania. Local TV productions (most using successful international formats) deliver performances over expectations, the sports events of the year (World Cup, Olympic Games) revitalized the media market on short term, and the media groups continue to invest in products.

The key word governing the media budgets allocation is performance / ROI. In Romania, TV attracts the most media investments (64%), while internet remains the only media that continues to grow, with contribution coming from “international” players such as Google, Facebook or Yahoo.

Although the local elections should’ve benefited outdoor, investments from electoral period were way beyond expectations. Outdoor posts a 4% decrease of media investments, compared to previous year.

Press continues to be the most affected by the decrease of media investments, with newspapers being the ones affected the most. Among newspapers, the hard blow went on tabloids, that, in the past, were in the top of advertising spending. Also, media consolidation doesn’t represent anymore a surprise on print market, as the market is decreasing.

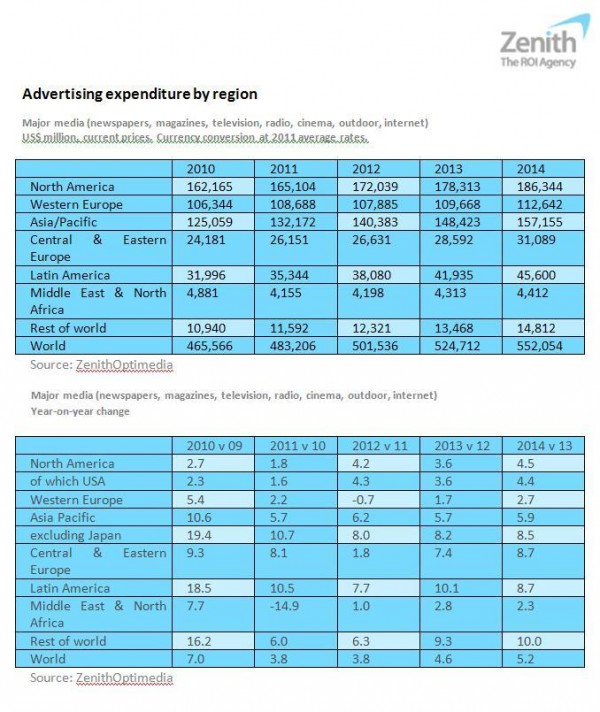

Worldwide, Zenith predicts global ad expenditure to grow 4.6% in 2013, to $525 bn by the end of the year. As since the economic downturn started in 2007, the growth will be led by developing markets, forecasted to grow 8% on average in 2013. Zenith expects CEE to bounce back after a tough 2012, with a 7.4% growth in 2013, while Asia Pacific (excluding Japan) will grow 8.2% and Latin America – 10.1%.

North America had a particularly strong 2012 thanks to record Olympic audiences and heavier than expected political advertising in the US. Also, it is estimated to keep growing in 2013, by 3.6%.

Digital media, mainly internet advertising, will generate most of the growth spend by medium: internet advertising is predicted to grow by 15.1% in 2013, while traditional media growth is expected to be of 2.3%.

Globally, the forecast was revised down in 2012, to 3.8% from a previous 4.3%, as advertisers have cut spending in the Euro zone in reaction to further economic weakness. ZO expects Euro zone to go down 3.1% in 2012, even if predicted smaller decline previously. As far as forecasting goes, the region will restart grow slowly, with a 0.9% growth in 2013 and 2.3% in 2014, assuming the eurozone remains intact.